11 Tips to Buy a Flipped House

Investors in California have been busy buying distressed homes to rehabilitate and renovate then sell for a 10%-50% profit margin. As a buyer, when you see a house that has been recently renovated, you need to ask your realtor if this renovation was done by the homeowner or flipped by an investor. There is an evident difference in the quality of workmanship and possible lingering issues yet to be addressed. Buyers: Do Your Homework. Ask for existing inspection reports Prior to submitting an offer, ask your realtor to request any inspection reports done by the seller or a previous buyer. Some investors will perform at least a pest inspection to avoid surprises that put a damper on the sale during a transaction. The seller must share the inspection report with potential buyers. So, do not hesitate to ask. Perform as many types of inspections as possible If the seller did not perform any inspections, you have no way of knowing the condition of the major parts of the house unless you order those inspections yourself. Yes, inspection cost is a direct up-front cost to buyers. Therefore, a set-aside budget for inspection costs needs to be accounted for prior to committing to purchasing a house. On older homes, the buyer should do the following inspections: Pest/termite, home, roof, sewer, and heating and air (HVAC). Structural inspection is necessary if recommended by any of the inspectors above or if you see a need for it. Be present during Inspections Inspect the House Thoroughly: Most buyers depend on their realtors or other agents to be present during inspections. Buyers do not need to be present during the entire period of inspections. However, it is extremely important for buyers to free themselves and be present by the end of inspections… say the last 20 minutes. Inspectors usually walk you through the house and show how things operate on one hand. Most importantly, they show you where the repair is a must or if the repair can wait. Being present during a walkthrough with inspectors will help you make a sound decision when you ask the seller for repairs. Check if Crawl Space is a Nightmare Houses either sit on a concrete foundation or a raised foundation. Raised foundation homes, especially those older homes, could have major dry rot and fungus. They might also have active termite and/or rodent activity. If the access to the crawl space is small and your inspector is unlikely to fit in, do not encourage skipping the crawlspace inspection to just finish the inspection task. You can ask the company to send someone who could fit through the opening. Rule of Thumb, since buyers are not likely to visually inspect the crawl space, ask the inspector to take photos for you. Pest inspectors usually do not take photos for the purpose of the report. If you do not ask them, they will not take any photos. If you are not present at time of inspection, you will miss on that opportunity. Venting is another issue in the crawl space. There must be a way for air to circulate under the house. If there is not sufficient venting from all sides, mold might build up and cause health issues and damage to subfloor wood. Check Cracks in Concrete Foundation If the house you are buying is on a concrete foundation, you need to watch for cracks and the size of cracks in concrete. If you see tangible-sized cracks in concrete outside the house, but running inside the house, you need to examine where the cracks are going inside the house. If there is a new carpet where you expect to see the tail of the outside cracks, then you have a problem that is worth checking. A structural engineer will be able to examine if the structure has major issues to address. Do not ignore Electrical Wiring and Main Switch Fire Hazard in Main Panel: Old main switches could be a fire hazard. Electrical re-wiring in an older house is a very expensive item for investor flippers. Re-wiring requires a licensed electrician, who usually charges thousands of dollars. Most flippers leave that task undone! Bad electrical wiring could lead to fire. Hidden wires in the attic could spark and lead to lighting of the insulation material. What’s in the Attic? Normally, there is insulation, air ducts, water pipes, and electrical wires in attics. The attic is also a storyteller. You can find out more history about the house than what’s in the living space. Inspectors, sometimes, find charred wood, which is clear evidence of a past fire. Most flippers do not know about a past fire if they have just recently bought the house and they have not done an inspection. It is a negotiation item for the buyer. The attic could have active rodents or evidence of it. The attic could have low or no insulation, which contributes to low-efficiency home and high utility bills down the road. Make sure the attic is properly inspected. Roof Inspection is a Must Water penetrates through rain boots on the roof. Roof repair or replacement is one of the high-ticketed price items in flipping a house. Almost all investors selling in the summertime will ignore roof repairs because shingles are dry and leaks do not show. If they are selling in a rainy season, they will do minimum repairs to cover any issues. The home inspector will climb and take photos. He also could recommend a roof specialist if he suspects major issues. Watch for mildew on shingle edges, missing shingles, debris from adjacent trees, and any patches recently done. Ask the seller to do all repairs Seller should agree to do all health and safety issues that appear on any and all inspection reports. Not all sellers agree to all repairs requested. As a buyer, you need to weigh in the cost of any items that are left unrepaired. Such items could jack up the home price for you and you might be better off buying a different property that do not have such issues. Pick Best Time to Buy a Distressed House Rain season is the best time to buy a House: Flipped homes are sold all year round. Buyers should buy flipped homes winter season and even best during the rainy season. Make sure to schedule an inspection on a rainy day! Why? Because only rain will show you if there are any leaks in the roof. Only rain will show the condition of the crawl space, which sometimes functions as a water collection pot. If that’s the case, major work needs to happen to divert water from going under the house and causing thousands of dollars in damages. The dual-pane windows will fog or you will see water condensation inside, which is evidence of the failing seal of the windows. Call, text, or email for advice on any issues you might have or to hire a realtor. Do You Want to Buy a Flipped Home? A professional realtor will handle your transaction and related inspections: Make sure that your realtor is a savvy agent when it comes to inspections. Your realtor needs to be equipped with sufficient knowledge about what to look for in a flipped home. Having fresh paint, granite countertop, new kitchen cabinets, and new floors might only be a trap for first-home buyers. Do not fall into that trap. What is hidden under and behind those nice finishes could be a deal breaker if you are lucky to discover them. For all your questions, contact me.

What is Escrow?

Escrow is a trusted neutral third party. They have the job of a trustworthy entity that communicates with the seller and the buyer equally. They keep the buyer's and seller's investment safe till the transfer of ownership. Once the buyer and seller sign an agreement, one of the realtors will hire an escrow and title company. A unique number is assigned by the company to every transaction. This is called "open escrow". This unique number is used as a reference to this specific property, buyer, seller, lender, bank, brokers, agents, etc. The buyer will use it to wire the initial deposit (earnest money) and the down payment to the escrow account. In a way, escrow is like the accountant in a property sale. They keep the buyer's initial deposit in a safe account called the "escrow account". Then they will either hand to the seller along with the lender's funds after the sale is final or return to the buyer if the sale is canceled. Because the escrow company takes orders from buyer and seller or their agents, they try to stay transparent to all parties. They will provide answers whenever they are asked as long as they have the information requested. Property Reports Escrow and Title companies also order required property reports, such as Natural Hazardous Report, Title Insurance Policy, and Preliminary Title Report, which they review in order to provide the buyer with a clear title for the property they are purchasing. They also prepare final settlements to buyer and seller. The final settlement document shows how much each party has in credit and debt by the closing date. In addition, they prepare all documents for signature and recording and they coordinate all appointments. If the seller or buyer cannot sign in person, escrow assigns a notary public to carry the closing documents to that party and collect all signatures. Escrow Fees For all their services, they charge about 1% to 2% of the home purchase price. Buyer and seller decide who pays escrow fees and may agree to pay it either by the seller, the buyer, or split between both according to the purchase agreement. In general, Southern California companies charge more than Northern California companies. Some companies charge base fees even if the transaction is canceled. Escrow Facts Other free services provided by escrow are pre-transaction services, such as buyer's and seller's net sheet, neighborhood mapping of homes, and mapping of owner occupancy and tenant occupancy. Most likely, realtors pick their favorite escrow company to work with. They are familiar with their staff, work habits, and have established a way to reach them at all times. Sellers and buyers would not mind which one to work with and they cannot tell the difference. Sellers and buyers who use the 1031 exchange program would prefer to stay with the same escrow company that handled their first transaction. (This is only for 1031 exchange customers. All others can skip this statement). Call or email for a free consultation.

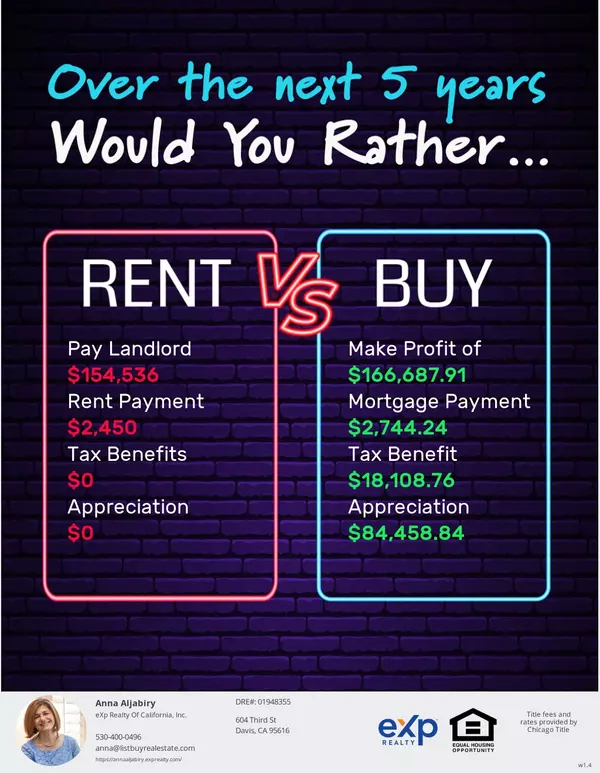

Down-Payment Myth for Home Buyers

Who said the down payment for buying a home is 20%? If you think this is how much you need to save, think again! Sometimes, the down payment could only be 3% (three percent) or as low as 0.5% (half percent.) The average down payment on a California home in 2017 is approximately 13%, as reported by several real estate sources. However, this is not the minimum down payment required nowadays. There are many options for those who cannot afford to put down 20 percent. Many mortgage programs allow family, friends, or employers to contribute by gifting the buyer a down payment or paying for other purchase expenses. Apply for a loan, it's easy Average Home Prices Home prices can vary depending on where you live. The actual down payment price differs depending on the home condition and location. For example, the median price of a home in California is approximately $495,000, and 13 percent of this would be $64,350. Since 13% is just an average, home buyers should not be intimidated when they start shopping for a house. Down payment requirements in California may be much lower depending on the type of loan used and whether the buyer received gift money from their loved ones. Down Payment Aide Financial aid programs could help you. This is why it is important for home buyers to look into the financial assistance programs offered by the city where their new home would be. They also need to explore other federal programs that could go hand in hand with the city programs for double dipping or even triple dipping! Sometimes, you get a check at the close of escrow instead of making a payment then. The criteria for qualification have greatly diminished regarding credit scores and debt ratios. It is important to speak to a professional loan officer or broker about your specific finances to explore your readiness to buy a house. Ask us how to start. Loan Types To get you up to speed with how flexible home loans have become, here is an update for minimum down-payment requirements in California: Conventional loans are not government-backed and usually require at least 5% down for residential properties, but lately there have been some 3% loans offered by some lenders. The minimum requirement for an FHA loan is 3.5 percent in all states, including California. These loans are granted in the private sector; however, the federal government insures them. With the VA program, veterans and military members can receive 100% financing, with no need for a down payment. In USDA rural development loans, 100% financing can also be granted; however, this program is usually limited to low to moderate-income buyers located in rural parts of the state. On top of all that, there are other city programs for financial aid. In Sacramento, for example, teachers could take advantage of the teachers’ assistance program when buying a house. If you, the home buyer, choose to put 20% of the home price as a down payment to avoid paying for private mortgage insurance (PMI), you can certainly do that. However, it is certainly not necessary. Get approved, your home is waiting, and we can help. Stop Renting, Explore Buying Get excited, because the minimum down payment is much lower than what you think. In California, it is a myth that home buyers should save 20% of the home they want to buy. If you think you could never save for down payment on a home, there are many loan options that could fit your financial situation and budget. You should not assume that you have to keep renting. You are still able to buy a home, but you don’t know it. Call or email for a free consultation.

Categories

Recent Posts