3 Mistakes to Avoid When Selling Your Home

After a slow and steady recovery from the 2007 housing collapse, US housing prices are finally returning to a point where it can be lucrative to sell. In fact, some studies even state that housing prices are increasing nearly 10% year over year. If you’re planning to cash in on this trend, selling

Make Your Home Energy Efficient

If you’re buying an older heritage home, it won’t be quite as energy-efficient as a modern home. But there are many construction styles, each with its own set of environmental issues. If you want to know how efficient a home is, you need some key information. When buying a home, you want to underst

10 Tips to Buy a House and Shop for Best Loan

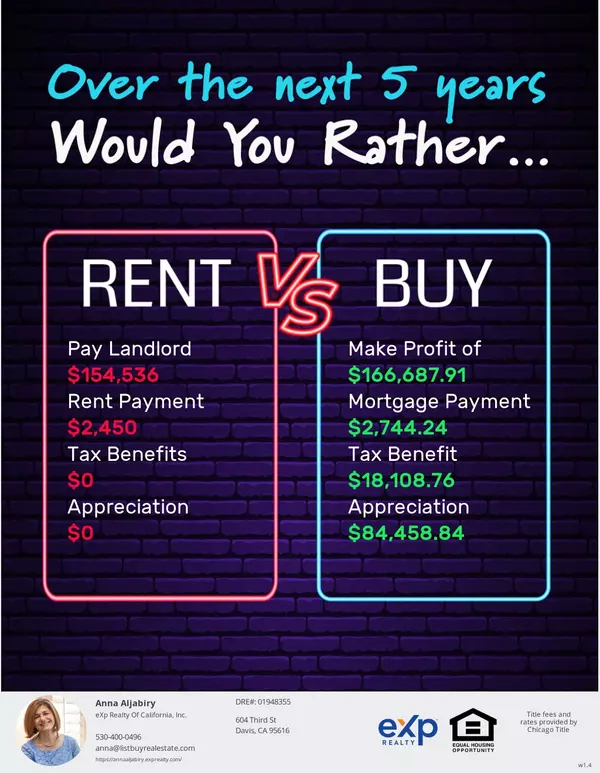

To most people, purchasing the first house is an overwhelming job. But countless other people were there before and lived to tell a story. If you do your homework upfront, there's a good chance of finding the best house and the best loan you can afford. To the surprise of most first-time home buy

Categories

Recent Posts