Down-Payment Myth for Home Buyers

Who said the down payment for buying a home is 20%?

If you think this is how much you need to save, think again! Sometimes, the down payment could only be 3% (three percent) or as low as 0.5% (half percent.) The average down payment on a California home in 2017 is approximately 13%, as reported by several real estate sources. However, this is not the minimum down payment required nowadays. There are many options for those who cannot afford to put down 20 percent. Many mortgage programs allow family, friends, or employers to contribute by gifting the buyer a down payment or paying for other purchase expenses.

Apply for a loan, it's easy

Average Home Prices

Home prices can vary depending on where you live. The actual down payment price differs depending on the home condition and location. For example, the median price of a home in California is approximately $495,000, and 13 percent of this would be $64,350. Since 13% is just an average, home buyers should not be intimidated when they start shopping for a house. Down payment requirements in California may be much lower depending on the type of loan used and whether the buyer received gift money from their loved ones.

Down Payment Aide

Financial aid programs could help you. This is why it is important for home buyers to look into the financial assistance programs offered by the city where their new home would be. They also need to explore other federal programs that could go hand in hand with the city programs for double dipping or even triple dipping! Sometimes, you get a check at the close of escrow instead of making a payment then. The criteria for qualification have greatly diminished regarding credit scores and debt ratios. It is important to speak to a professional loan officer or broker about your specific finances to explore your readiness to buy a house. Ask us how to start.

Loan Types

To get you up to speed with how flexible home loans have become, here is an update for minimum down-payment requirements in California: Conventional loans are not government-backed and usually require at least 5% down for residential properties, but lately there have been some 3% loans offered by some lenders. The minimum requirement for an FHA loan is 3.5 percent in all states, including California. These loans are granted in the private sector; however, the federal government insures them. With the VA program, veterans and military members can receive 100% financing, with no need for a down payment. In USDA rural development loans, 100% financing can also be granted; however, this program is usually limited to low to moderate-income buyers located in rural parts of the state. On top of all that, there are other city programs for financial aid. In Sacramento, for example, teachers could take advantage of the teachers’ assistance program when buying a house. If you, the home buyer, choose to put 20% of the home price as a down payment to avoid paying for private mortgage insurance (PMI), you can certainly do that. However, it is certainly not necessary.

Get approved, your home is waiting, and we can help.

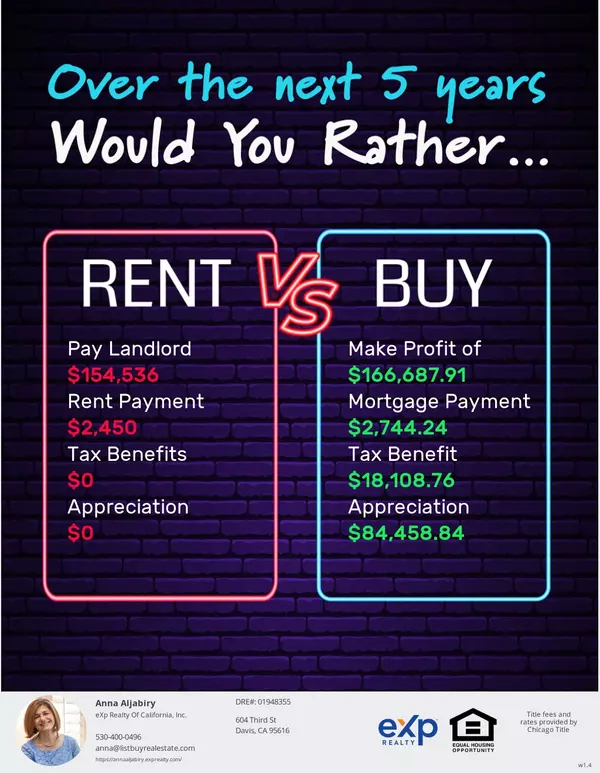

Stop Renting, Explore Buying

Get excited, because the minimum down payment is much lower than what you think. In California, it is a myth that home buyers should save 20% of the home they want to buy. If you think you could never save for down payment on a home, there are many loan options that could fit your financial situation and budget. You should not assume that you have to keep renting. You are still able to buy a home, but you don’t know it. Call or email for a free consultation.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "