What is Escrow?

Escrow is a trusted neutral third party. They have the job of a trustworthy entity that communicates with the seller and the buyer equally. They keep the buyer's and seller's investment safe till the transfer of ownership. Once the buyer and seller sign an agreement, one of the realtors will hire an escrow and title company. A unique number is assigned by the company to every transaction. This is called "open escrow". This unique number is used as a reference to this specific property, buyer, seller, lender, bank, brokers, agents, etc. The buyer will use it to wire the initial deposit (earnest money) and the down payment to the escrow account. In a way, escrow is like the accountant in a property sale. They keep the buyer's initial deposit in a safe account called the "escrow account". Then they will either hand to the seller along with the lender's funds after the sale is final or return to the buyer if the sale is canceled. Because the escrow company takes orders from buyer and seller or their agents, they try to stay transparent to all parties. They will provide answers whenever they are asked as long as they have the information requested. Property Reports Escrow and Title companies also order required property reports, such as Natural Hazardous Report, Title Insurance Policy, and Preliminary Title Report, which they review in order to provide the buyer with a clear title for the property they are purchasing. They also prepare final settlements to buyer and seller. The final settlement document shows how much each party has in credit and debt by the closing date. In addition, they prepare all documents for signature and recording and they coordinate all appointments. If the seller or buyer cannot sign in person, escrow assigns a notary public to carry the closing documents to that party and collect all signatures. Escrow Fees For all their services, they charge about 1% to 2% of the home purchase price. Buyer and seller decide who pays escrow fees and may agree to pay it either by the seller, the buyer, or split between both according to the purchase agreement. In general, Southern California companies charge more than Northern California companies. Some companies charge base fees even if the transaction is canceled. Escrow Facts Other free services provided by escrow are pre-transaction services, such as buyer's and seller's net sheet, neighborhood mapping of homes, and mapping of owner occupancy and tenant occupancy. Most likely, realtors pick their favorite escrow company to work with. They are familiar with their staff, work habits, and have established a way to reach them at all times. Sellers and buyers would not mind which one to work with and they cannot tell the difference. Sellers and buyers who use the 1031 exchange program would prefer to stay with the same escrow company that handled their first transaction. (This is only for 1031 exchange customers. All others can skip this statement). Call or email for a free consultation.

Down-Payment Myth for Home Buyers

Who said the down payment for buying a home is 20%? If you think this is how much you need to save, think again! Sometimes, the down payment could only be 3% (three percent) or as low as 0.5% (half percent.) The average down payment on a California home in 2017 is approximately 13%, as reported by several real estate sources. However, this is not the minimum down payment required nowadays. There are many options for those who cannot afford to put down 20 percent. Many mortgage programs allow family, friends, or employers to contribute by gifting the buyer a down payment or paying for other purchase expenses. Apply for a loan, it's easy Average Home Prices Home prices can vary depending on where you live. The actual down payment price differs depending on the home condition and location. For example, the median price of a home in California is approximately $495,000, and 13 percent of this would be $64,350. Since 13% is just an average, home buyers should not be intimidated when they start shopping for a house. Down payment requirements in California may be much lower depending on the type of loan used and whether the buyer received gift money from their loved ones. Down Payment Aide Financial aid programs could help you. This is why it is important for home buyers to look into the financial assistance programs offered by the city where their new home would be. They also need to explore other federal programs that could go hand in hand with the city programs for double dipping or even triple dipping! Sometimes, you get a check at the close of escrow instead of making a payment then. The criteria for qualification have greatly diminished regarding credit scores and debt ratios. It is important to speak to a professional loan officer or broker about your specific finances to explore your readiness to buy a house. Ask us how to start. Loan Types To get you up to speed with how flexible home loans have become, here is an update for minimum down-payment requirements in California: Conventional loans are not government-backed and usually require at least 5% down for residential properties, but lately there have been some 3% loans offered by some lenders. The minimum requirement for an FHA loan is 3.5 percent in all states, including California. These loans are granted in the private sector; however, the federal government insures them. With the VA program, veterans and military members can receive 100% financing, with no need for a down payment. In USDA rural development loans, 100% financing can also be granted; however, this program is usually limited to low to moderate-income buyers located in rural parts of the state. On top of all that, there are other city programs for financial aid. In Sacramento, for example, teachers could take advantage of the teachers’ assistance program when buying a house. If you, the home buyer, choose to put 20% of the home price as a down payment to avoid paying for private mortgage insurance (PMI), you can certainly do that. However, it is certainly not necessary. Get approved, your home is waiting, and we can help. Stop Renting, Explore Buying Get excited, because the minimum down payment is much lower than what you think. In California, it is a myth that home buyers should save 20% of the home they want to buy. If you think you could never save for down payment on a home, there are many loan options that could fit your financial situation and budget. You should not assume that you have to keep renting. You are still able to buy a home, but you don’t know it. Call or email for a free consultation.

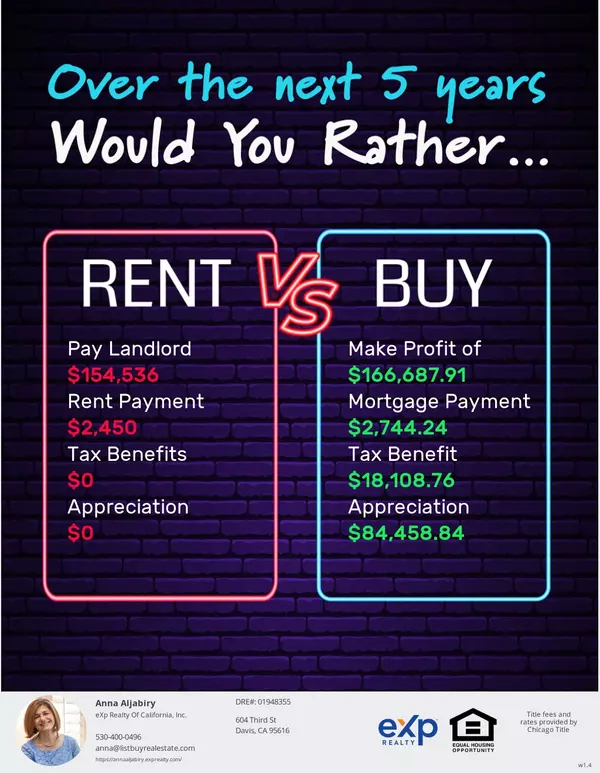

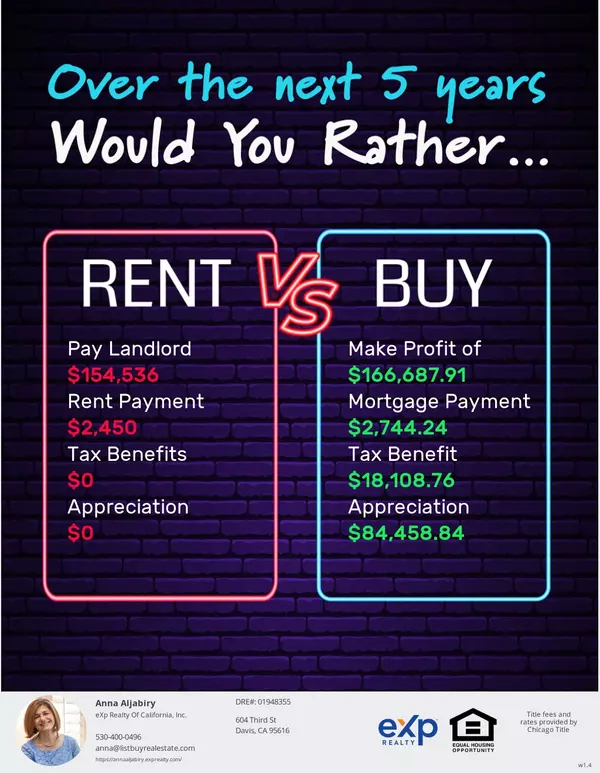

Invest in Real Estate: To Rent or To Buy?

Everyone needs a home. Should you rent a home or should you invest and buy your own? It may seem like a simple question, but the answer is different for everyone. Until 2007, many people considered real estate to be a bulletproof investment. Houses almost always appreciate, right? Today, we know that is not the case. There are potential risks, but there are also many advantages. To find out if homeownership is for you, there are a few things you should consider. What a Perfect Investment Looks Like In a perfect world, what would homeownership look like? The most important thing is your quality of life. Your home should meet all of your needs, and you should enjoy living there. This includes both the features of the home, as well as the local amenities. When it comes time to sell, you should earn a tidy profit and qualify for it to be tax-free. This is what renting vs buying is all about. The Financial Differences between Renting and Owning In the short term, renting appears to be the cheapest option. You don’t have to worry about maintenance, insurance, property tax, or a hefty down payment. If it costs $2,000 to rent and $3,000 to own, you might think that owning is more expensive. For some people, the cheaper option is better. Renting can save you money in the short term, but there are a few things you’ll miss out on. Choosing ownership gives you a mortgage interest tax deduction, and the profits from the sale of a home that are appreciated are very likely to be tax-free. You can rent the same place for 20 years and never get a cent back. Putting that same money towards a mortgage could have bought you a house. Why not buy now? The past is gone, and the future is unknown. There is no better time than now. Stretch Your Dollar with The Right House Haven’t found your dream home? In some cases, it’s worthwhile to buy a home with less appeal. When a home is unattractive, dated, or simply in need of a coat of paint, you’ll be able to purchase it for less than the appraised value. You can invest in some renovations, improving the chances that you’ll profit when selling. Not much of a handyman? Buy a home in an up-and-coming area? Neighborhoods going through the gentrification process, or property just outside of a quickly growing city stand a much higher chance of appreciating. Timing is Everything If you want a real estate purchase to be profitable, timing is one of the most important factors. You’ll want to buy a home when prices are low and sell when they’re high. How much is a home worth? It’s not the number on the appraisal report. It might not even be the price it’s listed for. Homes are worth what they sell for. Although nobody can predict what the housing market will do, your real estate agent understands the local market and can give you the advice you need. They’ll be able to help you buy at the right time and can help you time the sale as well. Every Situation is Different People buy real estate for various reasons. Some want to get the home of their dreams, while others want to see a return on their investment. If you can clearly define your needs, a real estate agent can help you determine if there is a home that will help you reach your objectives. Whether you want to make an immediate return on the investment or a long-term return, we can help you achieve these goals. Simply call or text 530.400.0496 to get your thoughts focused and finalized. This could be the best call you have ever made. Call or email for a free consultation.

Categories

Recent Posts