Invest in Real Estate: To Rent or To Buy?

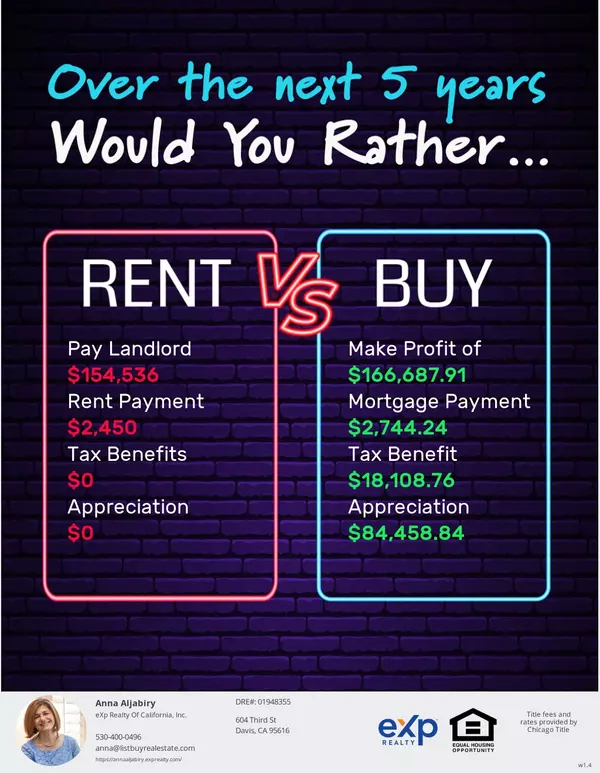

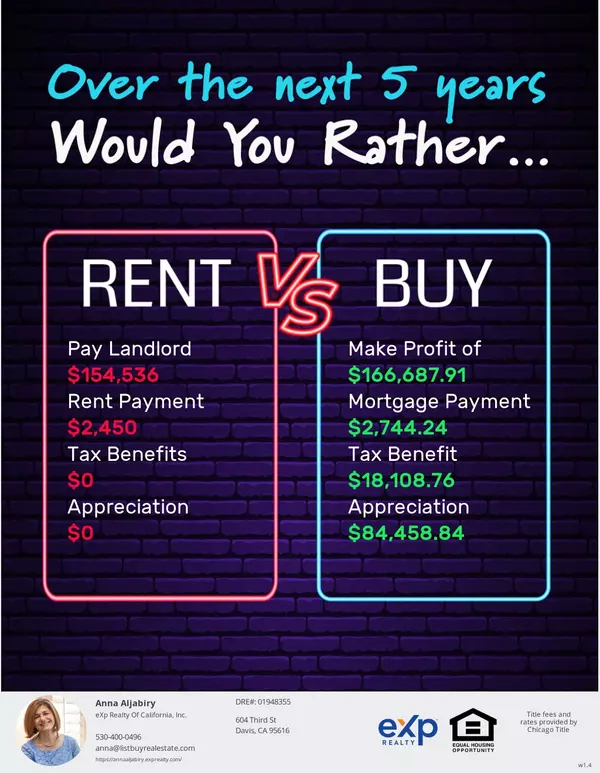

Everyone needs a home. Should you rent a home or should you invest and buy your own? It may seem like a simple question, but the answer is different for everyone. Until 2007, many people considered real estate to be a bulletproof investment. Houses almost always appreciate, right? Today, we know that is not the case. There are potential risks, but there are also many advantages. To find out if homeownership is for you, there are a few things you should consider. What a Perfect Investment Looks Like In a perfect world, what would homeownership look like? The most important thing is your quality of life. Your home should meet all of your needs, and you should enjoy living there. This includes both the features of the home, as well as the local amenities. When it comes time to sell, you should earn a tidy profit and qualify for it to be tax-free. This is what renting vs buying is all about. The Financial Differences between Renting and Owning In the short term, renting appears to be the cheapest option. You don’t have to worry about maintenance, insurance, property tax, or a hefty down payment. If it costs $2,000 to rent and $3,000 to own, you might think that owning is more expensive. For some people, the cheaper option is better. Renting can save you money in the short term, but there are a few things you’ll miss out on. Choosing ownership gives you a mortgage interest tax deduction, and the profits from the sale of a home that are appreciated are very likely to be tax-free. You can rent the same place for 20 years and never get a cent back. Putting that same money towards a mortgage could have bought you a house. Why not buy now? The past is gone, and the future is unknown. There is no better time than now. Stretch Your Dollar with The Right House Haven’t found your dream home? In some cases, it’s worthwhile to buy a home with less appeal. When a home is unattractive, dated, or simply in need of a coat of paint, you’ll be able to purchase it for less than the appraised value. You can invest in some renovations, improving the chances that you’ll profit when selling. Not much of a handyman? Buy a home in an up-and-coming area? Neighborhoods going through the gentrification process, or property just outside of a quickly growing city stand a much higher chance of appreciating. Timing is Everything If you want a real estate purchase to be profitable, timing is one of the most important factors. You’ll want to buy a home when prices are low and sell when they’re high. How much is a home worth? It’s not the number on the appraisal report. It might not even be the price it’s listed for. Homes are worth what they sell for. Although nobody can predict what the housing market will do, your real estate agent understands the local market and can give you the advice you need. They’ll be able to help you buy at the right time and can help you time the sale as well. Every Situation is Different People buy real estate for various reasons. Some want to get the home of their dreams, while others want to see a return on their investment. If you can clearly define your needs, a real estate agent can help you determine if there is a home that will help you reach your objectives. Whether you want to make an immediate return on the investment or a long-term return, we can help you achieve these goals. Simply call or text 530.400.0496 to get your thoughts focused and finalized. This could be the best call you have ever made. Call or email for a free consultation.

10 Tips to Buy a House

Purchasing your first house may be an overwhelming job. But countless people were there before you and lived to tell a story. If you do your homework, you will have the best possible chance of finding a place you'll be able to afford for a price you can manage. The major surprise for most first-timers is that they will need to complete the first five measures on this list before they can start searching for a house. Review your finances First, consider savings. Look into how much you could put aside for a down payment or save an additional amount for it. Next, review your monthly expenditure and figure out where to possibly cut down in order to allocate to mortgage payment. As you study the you consider moving to, calculate how moving to your new home will decrease or increase your daily commute costs. Find out programs for first-time home buyers. What is a good deal? Most cities within California have programs to assist first-time home buyers with the down payment and other closing expenses. Having some knowledge about the various available programs helps you choose the one that fits your needs, helps you understand your lender, and helps you plan for the final closing expenses. Contact Lenders Many realtors won't spend time with customers who have not verified their purchase ability with a lender. So, if you are not a cash buyer, and most first-time home buyers are not, speak to a lender or mortgage broker to figure out your ability to buy a home. Most lenders give you approximate numbers within a few hours. If you need actual approval, then you might need to wait a few days. A lender or agent will rate your credit rating and the amount that are able to qualify to get financing. That is where your homework on first-time house buyer applications can help. If you feel you qualify, start looking for a lender… call us for recommendations for local lenders. Do a little research online; however, having a 1-on-1 meeting with a lender will give you an immediate review of your financial situation, answer questions and, if needed, indicate how it is possible to enhance your credit score. Online calculators don't always include taxes and insurance or PMI (Private Mortgage Insurance policy necessary if the deposit is less than 20 percent). Online calculators also do not include loan fees. Go Shopping for a Loan. Do not allow loyalty to a family lender to block you from seeking a pre-approval or looking for a mortgage outside your circle of friends. It is best to shop around for loan even if you only qualify for a single type of loan. Different lenders charge different fees for the exact same loan type and loan amount. When you think you got the best deal on a mortgage, make sure to get pre-approval to avoid any surprises. Being pre-approved is better than just simply being pre-qualified. Why? Because pre-qualification means your lender bases his evaluation on what you tell him. Pre-approval means you provide your lender with all the paperwork necessary to run your credit. Keep a backup lender. Qualifying for a loan may not mean your loan will be approved. The underwriting guidelines and process is very tedious. A lender could suspend financing a loan at any point in time during the transaction and before close of escrow. Loan suspension can happen even after the lender approves a loan and after escrow documents are signed. A second lender who already qualified you for a mortgage gives you an alternate way to keep the loan process going with a different lender. Look for a realtor. Realtors do not charge buyers. The seller pays for all realtors’ commissions on both sides. You probably have already found a realtor who directed you to a lender (point 3 above). If you have not, then find a realtor once you get pre-qualified. You will be more confident and comfortable shopping for a home when you have a letter in your hand showing the amount of the loan you qualify for and the highest purchase price. call us for recommendations on the best realtors in your area. Choose a neighborhood. Your best location might not fit your budget. Try to explore various areas and give yourself a chance to compare prices and locations. The farther you get from metropolitan areas, the cheaper the homes are. On the flip side, it is an easy trap to think that the long commute is cheap. The stress and cost of a long commute can have a toll on marriages, health, and savings. So, it is a good idea to calculate how much the commute will cost you and if the cost of that commute is the same as your monthly mortgage difference if you live close to work. Revisit your numbers when you locate a house. When you are ready to make an offer on a house, review your budget again. This time, ask your realtor to provide you with closing costs and any other upfront expenses, such as necessary repairs. You also need to set aside some money for moving expenses, appliances, and furniture that you may need to buy before you can move-in to the house. Don’t forget to add the HOA (Home Owner’s Association) fee if required in that location. Review Utility Bills. Homes with high ceilings and more windows have bigger utility bills. Heating and cooling high ceiling spaces takes longer time. Windows could leak air and cause energy loss. Utility bills could soar. For those reasons, request the energy bills from the past 12 months to lay out a typical monthly price. Perform a Home Inspection. After your offer is accepted, you will need to order inspections. Cost of inspections can exceed $1,000. However, inspection reports will provide information about the home and help you determine if you want to make the necessary repairs. You can also leverage your offer depending on the results of the inspection report and make the vendor financially responsible for all or a few of the repairs. The Most Important Thing One of the biggest decisions and investments you could make is buying your first home. Try not to add more financial obligations to your plate. If you are thinking about buying a car, you may want to postpone it to avoid another debt on your credit profile. Therefore, it is wise to save more money for a down payment. The higher the deposit, the smaller the loan. The smaller the loan, the more comfortable your life will be. Call or email for a free consultation.

Is Davis Safe? Davis Schools Davis House Prices

**Navigating Life in Davis, California: Safety, Schools, and Real Estate Insights** Hello! I'm Anna al-Jabari, a real estate agent based in Davis, California, and today I'm excited to share essential insights for anyone considering relocating to this vibrant city. Whether you're a long-time follower or just stumbled upon our channel, buckle up as we delve into the most common inquiries about Davis. ### The Allure of Safety in Davis One of the most frequently asked questions I receive is about the safety of different neighborhoods in Davis. As a resident for nearly 25 years, I can confidently assure you that Davis is a secure environment for families and individuals alike. The city spans a modest six-mile radius, and you'll find that safety is consistent throughout, regardless of where your penny drops on the map! ### Choosing the Right Neighborhood While all areas in Davis boast safety, selecting the right neighborhood depends on several other factors. These include proximity to public transportation, schools, downtown, grocery stores, and the extensive green belts and bike lanes that define our city's landscape. Budget, however, remains a critical determinant in choosing a home, with diverse housing options available to suit various financial capabilities. ### Educational Excellence Education is a cornerstone of the Davis community. Our schools are top-notch, with Davis High School serving as the culmination of a stellar educational journey that begins in elementary at institutions like North Davis Elementary and extends through junior highs like Emerson and Harper. For those in higher education or seeking excellent schooling for their children, Davis’s educational system is a formidable asset. ### Real Estate Market Overview Davis's real estate market is as diverse as it is dynamic. From affordable units in the Buena Veda area to more upscale homes in neighborhoods like Aspen and Evergreen, the market caters to a wide range of preferences and budgets. Recent sales have shown a variety of homes from smaller, affordable condos to larger, more luxurious residences, with prices reflecting both the size and the specific locales within the city. The closer you get to downtown, the higher the price per square foot, reflecting the desirability of these areas. ### Fun Facts about Davis Before we wrap up, here are some fun facts about Davis:- Although UC Davis is synonymous with the city, it’s technically located in an unincorporated area adjacent to Davis.- Some homes in downtown Davis date back to the early 1900s, showcasing the city’s rich history.- Davis has maintained the same ZIP code, 95616, underscoring its small-town charm amidst growth. ### Conclusion If you're contemplating a move to Davis or simply want to learn more about what makes it a unique place to live, subscribe to our channel for updates. We cover everything from detailed real estate trends to community features that make Davis a wonderful place to call home. Thank you for joining me on this journey through Davis, California. If you have any more questions or need personalized advice on moving to or within Davis, feel free to reach out. Here's to finding your perfect spot in this exceptional city!

Categories

Recent Posts